Investing in AI through Nvidia: Separating Hype from Reality

Understanding Nvidia's Business Model and Products

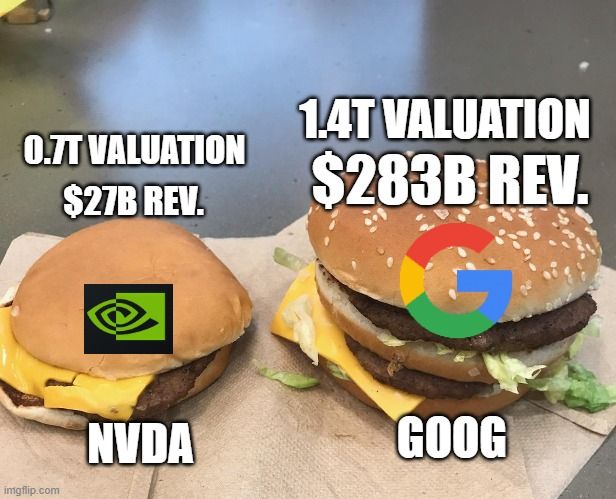

Nvidia, founded in 1993, specializes in the design and manufacture of graphics processing units (GPUs) for gaming and professional markets (like architects, engineers, game designers, scientists, and data analysts). Its primary product line, GeForce, is targeted at gamers and includes both desktop and laptop GPUs. Nvidia has also expanded its product offerings to include GPUs for professional visualization, data center, and automotive markets. In 2022, NVIDIA had a record-breaking year selling $27 billion but was almost flat compared to 2021.

Under the Compute & Networking segment ( 52% of rev. & grew 36%), NVIDIA provides data center platforms and systems for AI, high-performance computing (HPC), and accelerated computing workloads. This includes products such as Tesla GPUs, DGX systems, Drive for the Automotive segment and Mellanox networking solutions.

Under the Graphics segment (49% of rev. & decreased 25%), NVIDIA provides GPUs for gaming PCs and consoles, as well as professional visualization solutions for industries such as architecture, engineering, media, and entertainment. This includes products such as GeForce GPUs, Quadro GPUs, and RTX technology.

In addition to hardware sales, NVIDIA also generates revenue from software licensing fees for its CUDA parallel computing platform and other software tools (used by almost 3 m .8 million developers worldwide). The company also offers consulting services to help customers optimize their use of NVIDIA's technology in their applications.

Nvidia's Position in the AI Market

GPUs are at the center of the AI transformation because of their parallel processing capabilities and ability to handle large amounts of data, much more adapted to run AI models than traditional CPUs. The NVIDIA Tesla series for example is currently considered one of the best GPUs for running AI models.

Nvidia enjoys a dominant position in the GPU market, with a market share of around 80% in the discrete desktop GPU segment. Its main competitor, Advanced Micro Devices (AMD), holds the remaining market share. This duopolistic market structure has allowed Nvidia to maintain strong pricing power and high margins.

Furthermore, Nvidia has made its hardware much stickier thanks to an end-to-end platform for AI and machine learning called Nvidia AI, which combines hardware, software, libraries, and tools to enable developers and businesses to harness the power of AI.

As AI and machine learning continue to permeate various industries, from healthcare and finance to manufacturing and transportation, Nvidia stands to benefit greatly from this growing market. According to a report by Grand View Research, the global AI market is expected to grow at a compound annual growth rate (CAGR) of 40.2% from 2021 to 2028, reaching a market size of $997.8 billion by 2028.

Why did Nvidia´s net incomes plummet in 2022?

NVIDIA's gross margin fell in the fiscal year ending in Jan. 2023 because they had to write off a lot of inventory. They recorded $2.17 billion of inventory provisions, which means they had too much supply of their products compared to the demand, especially in China impacted by COVID´s restrictions. This led to a decrease in gross margin because they had to write off some inventory. The overall effect on NVIDIA's gross margin was an unfavorable impact of 7.5%.

Plus, capital expenditures (capex) for fiscal year 2023 jumped $850 million (+87%) due to investments in property and equipment related to NVIDIA's data center and infrastructure expansion. This includes investments in new facilities, equipment, and infrastructure to support the growth of NVIDIA's data center business. NVIDIA expects its capex to continue to increase in the future as it invests in expanding its data center business and other growth opportunities.

Finally, their R&D expenses were +31% higher (+$2.3 billion)

Risks and Challenges Facing Nvidia

Firstly, competition in the GPU market is intensifying. AMD has been aggressively investing in its GPU technology, and its recent product launches have received positive reviews from customers and industry experts alike. Furthermore, Intel, the world's largest semiconductor company, has announced plans to enter the discrete GPU market, potentially posing a threat to Nvidia's market share and pricing power.

Secondly, Nvidia's success in the AI market has attracted the attention of both established technology companies and startups. Companies like Google, Amazon, and Apple have been investing heavily in their AI capabilities, developing custom AI hardware and software solutions. Additionally, a plethora of AI-focused startups, such as Graphcore and Cerebras Systems, are working on next-generation AI chips, aiming to challenge Nvidia's dominance in this space.

Finally, Nvidia is subject to risks associated with the cyclical nature of the semiconductor industry, which can be influenced by factors such as economic cycles, inventory levels, and technological advancements. Additionally, Nvidia's reliance on third-party foundries for manufacturing its chips exposes the company to supply chain risks, including capacity constraints, production delays, and quality issues.

Evaluating NVDA's Stock Valuation and Forecast: the bull case

Growth forecast

NVIDIA will maintain its leadership in the GPU market for artificial intelligence (AI) technology and the demand will grow exponentially from a wide range of industries. In this scenario, we trust Nvidia´s numbers shared in the transcript of the Fiscal Q4 2023 when the CEO mentioned that the TAM was $300 billion for hardware and $300 billion for software. In this scenario, we forecast that Nvidia will grow to half of this $600 billion opportunity by 2033. By then it will have around 10 million developers using its enterprise solutions with an ARPU of $22k (up from an estimated $3.5k today), and 350 million gamers with an ARPU of $323 (down from an estimated $539 today as more gamers migrate to the cheaper Cloud gaming sub).

Profitability forecast

The company will maintain its strong track record of innovation to maintain a competitive edge, increasing its pricing power and network effects. Nvidia is exploring new products in about every field you can think of, from Maxine & Broadcast for live audio and video optimization, Canvas for digital drawing AI augmentation, Shield TV for Media Streaming augmentation on TVs, Bionemo for drug discovery (powering open-sourced models such as Google´s AlphaFold), Merlin for recommendation engines, Isaac for Robotics, Aerial or Telcom, Metropolis for Video analysis, RAPIDS for data analysis, Omniverse for AR/VR apps, Riva for conversation and speech processing, and many more. It is hard to keep track of all their announcements. A few days ago they released a demo of their "text-to-video" generative AI program, which seems powerful. Most of these software are free to use but require Nvidia hardware to work. As a consequence, NVIDIA's operating margins will grow to 58% (from 33% today).

A Cautionary Tale: The Bear Case for NVDA

Growth forecast

The company will grow to 17% of the $600 billion opportunity, tripling in revenues by 2033. By then, it will have more than 6 million developers using its enterprise solutions with an ARPU of around $11k, and more than 100 million gamers worldwide clocking a $323 ARPU.

Profitability forecast

NVIDIA operates in a highly competitive industry with rapidly changing technology and customer preferences. Plus, it is subject to significant regulatory and legal risks, including intellectual property disputes and antitrust investigations. NVIDIA's operations are also subject to significant supply chain risks, including disruptions in the supply of key components or materials as it depends on the foundry to manufacture their GPUs and could fail from grace with their Chinese customers. The competitive, legal, and supply chain constraints will force them to ever increase their R&D expenses and CAPEX in things like data centers to provide its Geforce Now cloud gaming services. This will put pressure on operating margins which will stabilize close to current levels at 35%.

Conclusion: Making an Informed Decision on Nvidia Investment

Nvidia's stock has performed impressively in recent years, delivering a whopping +89% year-to-day as of April 24th, and 108% since I first recommended it in October 2020. But after averaging the bull and bear case detailed above, and evaluating the outcome with a traditional DCF model (link to the detailed model spreadsheet), I come to the conclusion that Nvidia is about 44% overvalued, with too much growth and high margins expectation built-in current price levels.

From this level, I would not expect a market-beating return from an investment in Nvidia today, looking at the next 10 years. In fact, a reverse DCF suggests that Nvidia would need to grow its Free Cash Flow at a 80% CAGR for the next 5 years to justify its current $270 price, which is insane (Analysts forecast it to grow 27% 5Y CAGR). I am closing all my NVDA position. I love the company, but not its price. I could be probably wrong, time will tell. If you seek exposure to the burgeoning AI market, I would suggest looking elsewhere.

Ultimately, the decision to invest in Nvidia should be based on a thorough assessment of your investment goals, risk tolerance, and the company's prospects. As with any investment, it's essential to conduct your research and consult with a financial advisor before making a decision.

Rookie Scorecard for NVDA: 9.5 out of 26, in the lowest half of my watchlist

Network effect: 2/2

One example of Nvidia's network effects is its CUDA platform. As more developers use CUDA to develop applications that run on Nvidia GPUs, it creates a larger ecosystem of applications that can leverage the power of Nvidia's hardware. This makes it more attractive for other developers to use CUDA since they can tap into this existing ecosystem of applications and tools.

Another example is Nvidia's gaming business. As more gamers adopt Nvidia's graphics cards for their gaming PCs, it creates a larger user base that game developers can target with their games. This makes it more attractive for game developers to optimize their games for Nvidia's hardware since they know there is a large user base that can benefit from those optimizations.

Switching costs and price premium: 1/2

For Nvidia's customers in the gaming market, switching costs may be relatively low since there are several other companies that offer similar products such as AMD and Intel. However, for customers in the data center market who have invested heavily in Nvidia's GPUs and software tools such as CUDA, switching costs may be higher due to the need to retrain employees on new systems and workflows.

CUDA is free to use and there are around 3 million developers already using it. To use CUDA, developers need to have an Nvidia GPU installed on their computer or server.

Revenue Quality: 1/2

Most personal GPUs are sold as one-offs. However, in the data center market, enterprise customers may be sold through long-term contracts. In the gaming market, Nvidia's GeForce NOW cloud gaming service operates on a subscription model where users pay a monthly fee to access games on Nvidia's servers. This provides a recurring revenue stream for Nvidia as long as users continue to subscribe to the service.

Profitability: 1/3

While Nvidia's operating margin is extremely sound at 20.8% and better than the semiconductor industry, it has been on the decline over the past 5 years.

Barriers to entry: 0.5/1

One of the main barriers to entry in Nvidia's markets is the high cost of research and development (R&D) required to develop advanced GPUs and software tools. Nvidia invests heavily in R&D to develop new products and technologies that can meet the demands of its customers. This requires significant financial resources and technical expertise that may be difficult for new entrants to replicate.

Intangibles: 1/2

The strong brand recognition that Nvidia has built over the years. Nvidia is a well-known brand in the GPU market, with a reputation for high-quality products and innovative technologies. This brand recognition can make it difficult for new entrants to gain traction with customers who may be more likely to stick with established brands like Nvidia. In addition, Nvidia has developed strong relationships with key customers in its target markets such as data center operators, game developers, and automotive manufacturers. These relationships can provide a competitive advantage, a bit like Microsoft with their Office licenses.

Future Growth: 3/3

NVIDIA is forecasted by analysts to grow revenues by 21% per year for the next 5 years. In my own valuation, I went more aggressive, and the average between my bear and bull case put the next 5 years revenues CAGR to 31%.

Concentration in either clients or products: -1/-2

While no customers account for more than 10% of its revenues, they do depend on Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform for their data center business. If one or more of these customers were to reduce their purchases from Nvidia or switch to a competitor's products, it could have a significant impact on Nvidia's revenues. These behemoths are customers and competitors, as they all develop their own custom chips and solutions that compete with Nvidia's offerings in the accelerated computing market. There are some perverse incentives at play.

Capital allocation Health: 0/1

Ok, $13 billion in cash, but not phenomenal. Overall it fares 7 out of 10 in GuruFocus "Financial Strength" composite index.

Resilience: 1/1

It did generate profit for each of the past 10 years, so kudos.

Value creation Track Record: 1/3

Nvidia has been growing its free cash flow at a 13% annual rate in the past 5 years, however, it has decreased by 4% in the past 3 years.

Exposure to economic cycles: -1/-2

Definitely, semiconductors is usually a cyclical industry, but the fact that they made record revenues in 2022 while inflation was sky high and the stock market plummeted shows it has some resilience to face the economic cycles.

Other macro risks: -2/-2.

Nvidia's revenue from China (including Hong Kong) was $5.8 billion for the fiscal year ending January 30, 2022. This represents approximately 21% of Nvidia's total revenue for that fiscal year. As the AI race between China and the US intensifies, I would not be surprised to see these revenues get wiped out. In fact, some of Nvidia´s most advanced GPUs have already been banned in 2022 for export to China by the US government.

Company´s management Grit (mix of passion and perseverance): 2/3

Insiders own approx. 4% of the company, not too shabby but not great either. The company mission "accelerate the world's transition to artificial intelligence" is dope, people seem to be happy to work there (according to tp Glassdoor) and the founder is still in charge.

Smart money signals: 0/4

More hedge funds have been selling than buying during Q4 2022, no insiders have been buying lately as of April 2022 and Analysts' target is less than 20% above the current price. Nothing to see here.

Disclaimer

The Rookie Investor recommends DOCU. The Rookie Investor has a disclosure policy. This article by The Rookie Investor is not financial advice as it does not take into account your objectives or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.