This high-growth & long-term-value stock for the future of digital screens📺 just got some insider action👁🗨

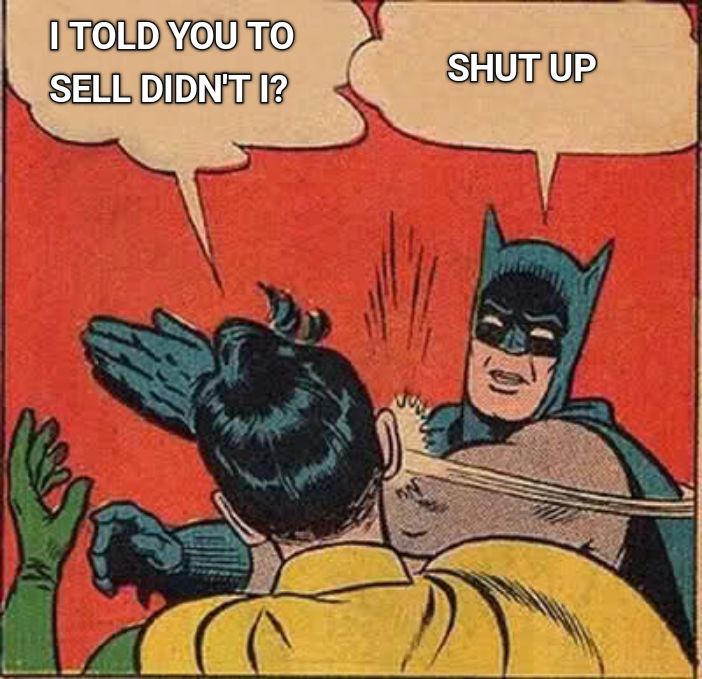

We just had a couple of crazy weeks with a lot of volatility. Like me, the rookie investors heavily invested on growth stocks after a rocket 2020 years got hurt. It hurts to see you are 20 to 30% in green for the year, and a few days later, you are back to square one. It hurts even if I was well aware it could happen at any moment. It hurts even if it could have been worse if I had not prepared myself mentally and strategically.

At least we are still in the green for the year (for now). This is why it is not good to look at your portfolio every single week, let alone every single day. It makes you worry unnecessarily or, worse, make bad decisions, such as selling in the dip. I failed badly at resisting the urge to look, but I am getting better and not making bad decisions in these moments. "Kind of" preparing for such an event helped a little bit.

Some insiders seem to like current market conditions.

At least within my watchlist. By now, you should know that I track every insider buying of my stocks watchlist. It helps me prioritize what company I will focus on next, as I don´t have the time to analyze every one of the 200...ish companies I find interesting.

The thing is, after so many stocks from my watchlist are down more than 10%, and 9 different stocks from my watchlist with insiders buying in the past 3 weeks, it is still hard to know where to look.

The Rookie Investor just got an upgrade.

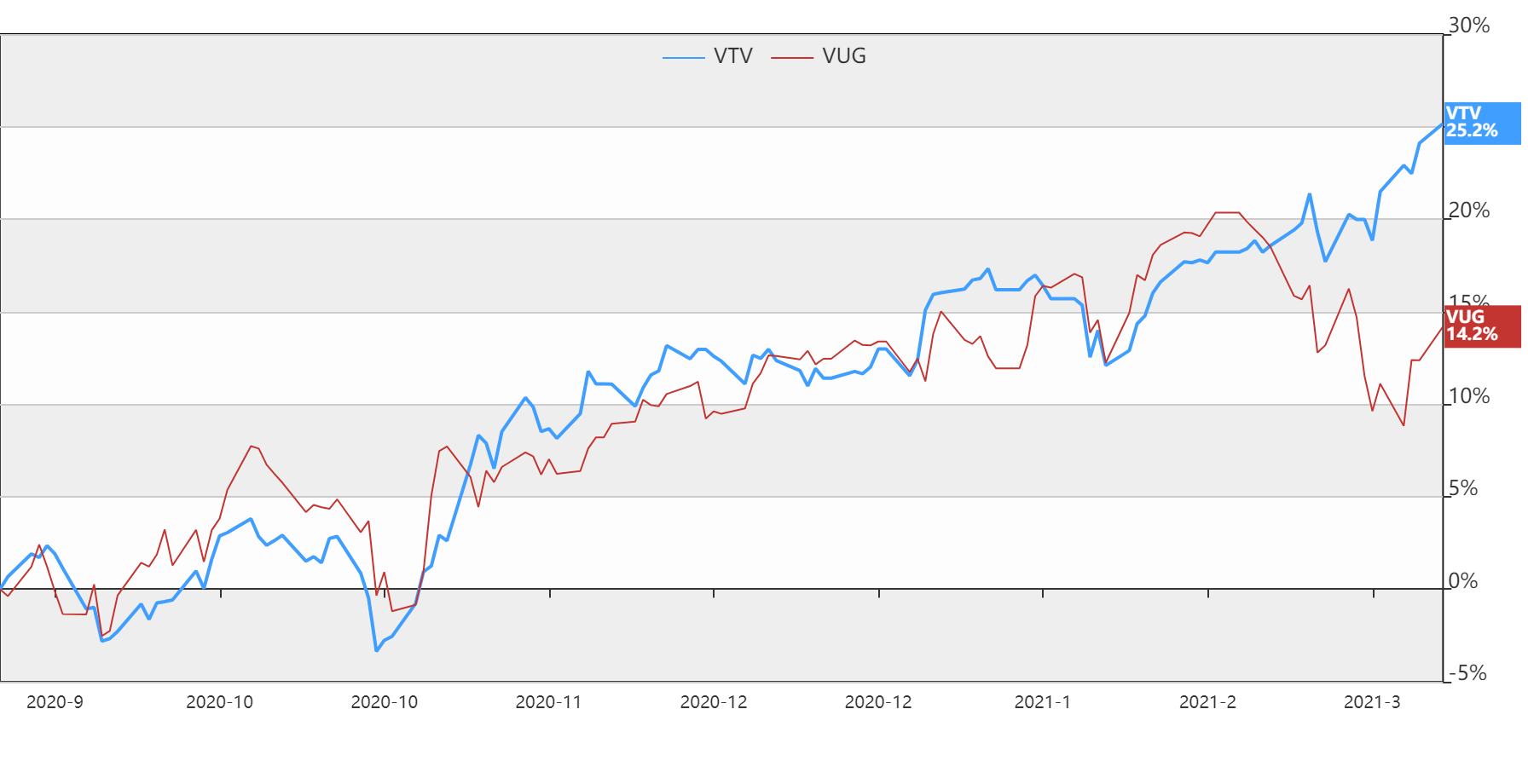

Remember the update I made to my scorecard adding some value oriented metrics? It turns out it was timely, as value stocks trounced growth stocks recently.

I have been working this year on automating 60% of myscorecard. The rest of it is manual. Still, we now have another useful tool to know where to look first and never miss the best investment opportunities out there. And guess what? One of my top 3 stocks based on that automated score also had an insider move 3 weeks ago: OLED (Universal Display Corporation).

I present you OLED

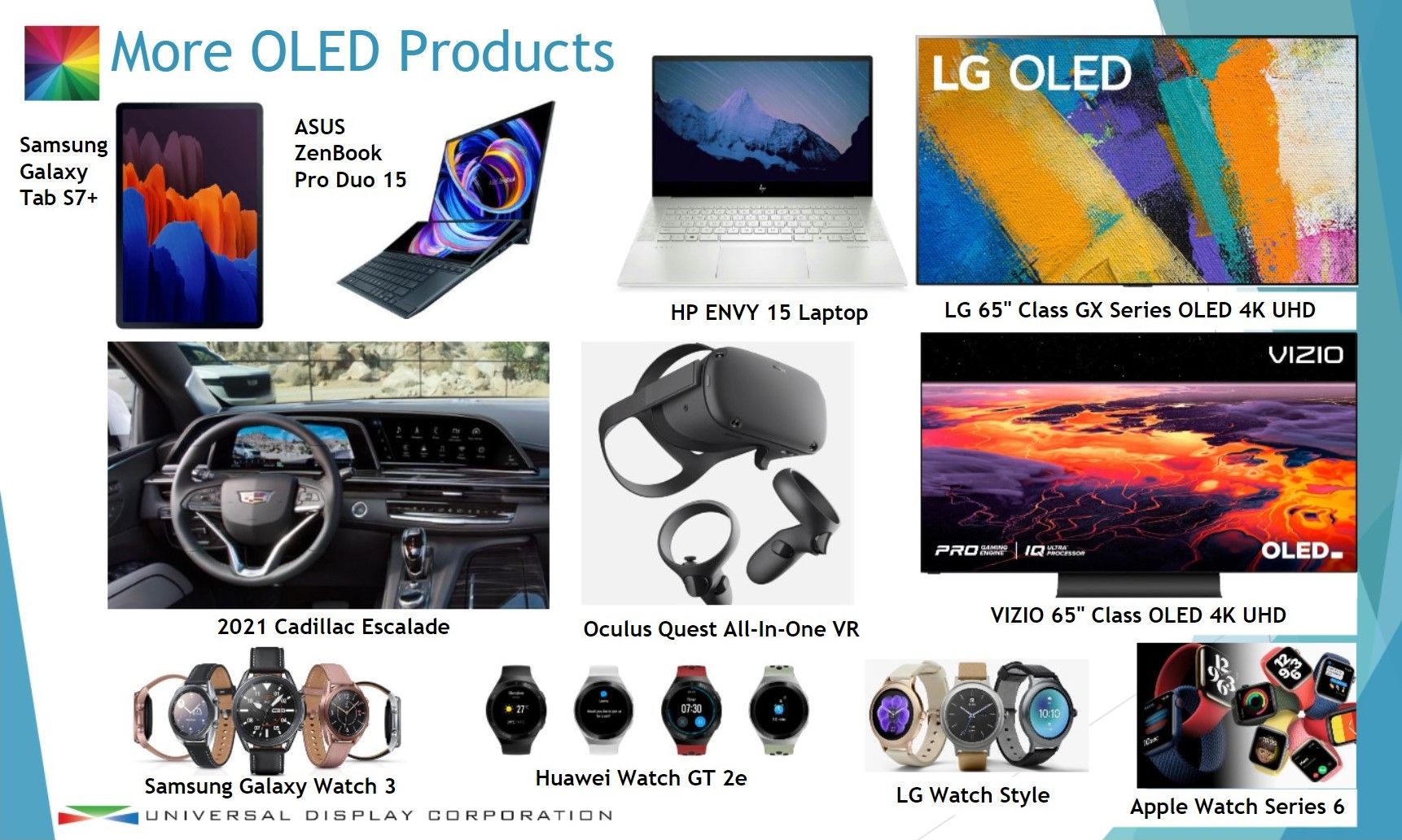

Universal Display (NASDAQ:OLED) is one of the leading manufacturers and license sellers for the Organic Light Emitting Diode used in TV and smartphone screens. OLEDs are both used for displays and lighting. OLEDs are not just thin and efficient; they can also be made flexible and transparent. On Feb 23rd, one of its directors bought half a million USD in shares at $207 per share on average.

Tailwinds

Universal Display (UDC), the only pure-play in the OLED display market, is well-situated to benefit from the ongoing transition from LCD displays in the mobile market to OLED smartphones, tablets and laptops (less than 45% of this market has OLED screens today). The company is also benefiting from growth in OLED-TVs, currently a tiny slice of the premium TV market (less than 2% as of today). Growing OLED manufacturing capacity, particularly in China, is expected to drive continued strong growth in materials, royalty and license revenues for UDC over the next two years.

Headwinds / Risks

The most significant risk, in my view, is its customer concentration: 70% of sales were attributable to Samsung and LG. While this makes

sense (Samsung represents over 90% of small OLED displays and LG over 90% of large panel displays). It subjects the company to inventory adjustments and some erratic purchasing patterns inherent to the early development of a market.

Long lead times for incremental capacity will remain the near-to-intermediate-term gating factor as many announced capacity additions are targeted at 2020 and beyond.

There are competing techs: TADF (thermally activated delayed fluorescence), which has generated significant industry buzz in the past year as a potentially more efficient emitter material. However, TADF remains very early in its commercial journey. Quantum dots, in turn, have generated the most attention and to date has been the next-gen TV technology of choice for Samsung (the QLED product line). Quantum dots improve performance and reduce power while utilizing the existing LCD infrastructure.

To date, a majority of the OLED market has been targeted at mobiles and wearables. To dramatically expand the addressable “square acreage” for OLEDs, the industry will need to cost-effectively scale OLEDs for TVs (the average TV has 100x the area of substrate versus the average mobile display). Universal Display is, however, well-positioned to tackle this challenge. Recent advances in its organic vapor jet printing (OVJP) tech show promise and could aid in the commercialization of large-area OLEDs at greater efficiency.

OLED Fundamentals

Fundamentals and Insider buying are what made OLED pop up on my radar. It is a beautifully run company. Check this out.

Moat & Potential: 10/12

Universal Display is a pick-and-shovel stock for the future of electronic display. It sells its proprietary manufacturing processes and basic materials to others, which builds recurring revenues, long-term commitments from the manufacturer, who has to adapt their operations to UDC's tech & materials, which in turn produces high switching costs.

But its most fabulous moat is probably its 46% operating margin, a lot higher than the sector average, and it is growing!

Financial fortitude and risk management: 3/7

UDC balance sheet is as good as it can be. It has no debt, a lot of cash, and pays a tiny but reliable dividend. Best of all, its 10 years historic Return on Invested Capital (ROIC) is sky-high at 25%, and growing! Its 47% average Earnings per share growth of the last 5 years is also impressive

Last but not least, it managed to produce a profit in each one of the past 10 years. That shows how resilient and capital-light this business is. So why doesn´t it scores higher in this pillar? Because of its customer concentration and exposure to economic cycles, as people should buy fewer TVs and high-end mobile phones in a downturn.

Skin in the game and culture: 0.5/3

UDC executives have enough skin in the game (about 9% of insiders ownership), plus its founder is still around. But its glassdoor ratings lack behind, and its mission/vision failed to inspire me.

Momentum & Valuation: 2/5

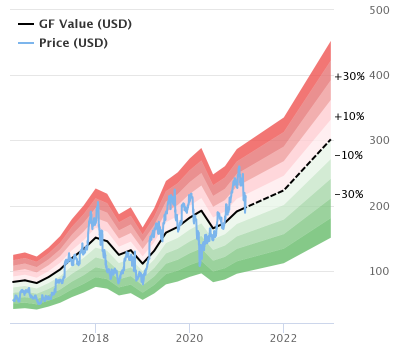

The most significant momentum signal I see is, of course, insider buying shares. On the growth side, after the slump in 2020, the initial outlook for 2021 looks especially promising. Revenue is expected to be up at least 23% year over year. Even with a price-to-earnings ratio incredibly high, its current valuation is actually fair based on the Gurufocus DCF model.

On the flip side, analysts´ mean target price is not far from today´s price (240 USD vs. 220 USD today).

Final Thoughts

Universal Display scores a solid 15.5 on my scorecard. I consider everything above 15 a super strong buy, and there are only 11 companies on my watchlist that achieved such a score right now. That, coupled with the fact that its valuation makes sense on a discounted cash flow base and positive insider signals, makes this a solid buy recommendations and one of my highest conviction stock right now.

By the way, if you want some more stock ideas to take advange of the recent pullbacks, I highly suggest you check my past review of Nvidia (NASDAQ:NVDA), more relevant than ever. It is also my top scorer stock on watchlist right now.

Happy investing!

You can see my live portfolio, my stats, or even copy my trades, on eToro, which is the broker I use. In case you do open an account with eToro, use this referral link, let me know and win 100 USD cash.

If you like my content you can subscribe for free and follow me on Twitter.

The author of this post owns shares of Universal Display Corporation. The Rookie Investor recommends Universal Display. The Rookie Investor has a disclosure policy.